What really happened to Malcolm X?

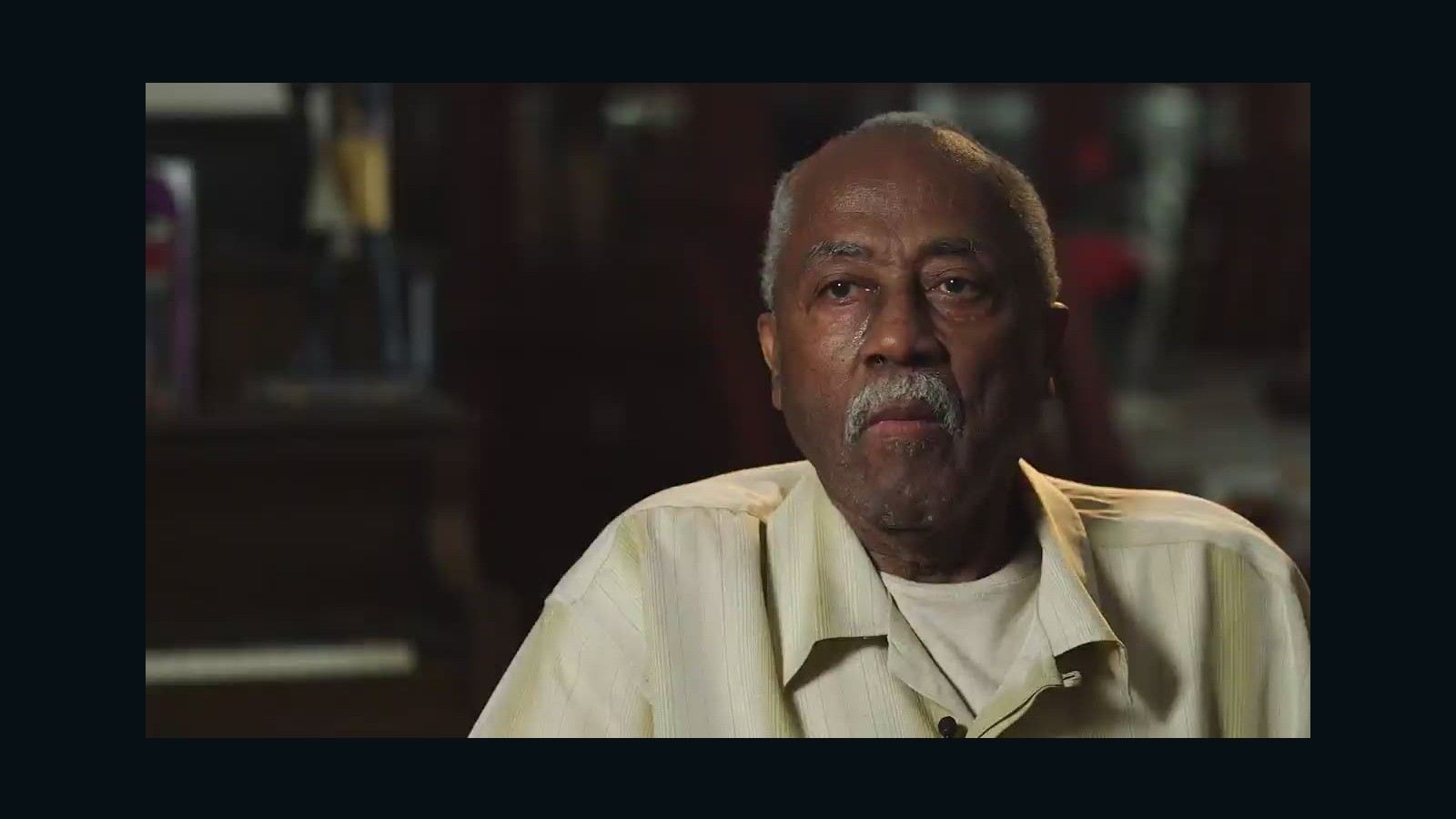

Earl Grant on the moments after Malcolm X's murder 01:06

Story highlights

- Malcolm X was assassinated on February 21, 1965

- Zaheer Ali: Fifty years later, we still have more to learn from Malcolm X's life

Zaheer Ali served as project manager of the Malcolm X Project at Columbia University, and as a lead researcher for Manning Marable's Pulitzer Prize-winning Malcolm X: A Life of Reinvention. He lectures on African American history. The views expressed are his own. Tune into a CNN special report, Witnessed, The Assassination of Malcolm X, tonight at 9p ET.

(CNN)When

Malcolm X was assassinated on February 21, 1965, many Americans viewed

his killing as simply the result of an ongoing feud between him and the

Nation of Islam. He had publicly left the Nation of Islam in March 1964,

and as the months wore on the animus between Malcolm's camp and the

Nation of Islam grew increasingly caustic, with bitter denunciations

coming from both sides. A week before he was killed, Malcolm's home --

owned by the Nation of Islam, which was seeking to evict him -- was

firebombed, and Malcolm believed members of the Nation of Islam to be

responsible. For investigators and commentators alike, then, his death

was an open and shut case: Muslims did it.

Yet

although three members of the Nation of Islam were tried and found

guilty for the killing, two of them maintained their innocence and

decades of research has since cast doubt on the outcome of the case.

Tens of thousands of declassified pages documenting government

surveillance, infiltration and disruption of black leaders and

organizations -- including Malcolm X and the Nation of Islam -- suggest

the conclusions drawn by law enforcement were self-serving. Furthermore,

irregularities in how investigators and prosecutors handled the case

reflect at best gross negligence, and at worst something more sinister.

At

the time of his death, Time magazine remembered Malcolm X

unsympathetically as "a pimp, a cocaine addict and a thief" and "an

unashamed demagogue." But for those who had been paying closer attention

to him, Malcolm X was an uncompromising advocate for the urban poor and

working-class black America. Instead of advocating integration, he

called for self-determination; instead of nonviolence in the face of

violent anti-black attacks, he called for self-defense. He reserved

moral appeals for other people committed to social justice; the

government, on the other hand, he understood in terms of organized power

-- to be challenged, disrupted and/or dismantled -- and sought to

leverage alliances with newly independent African states to challenge

that power.

It was his challenge

to the organized power of the state that appealed to growing numbers of

African-Americans, and it was this challenge that also attracted a close

following among federal, state and local law enforcement. Under Federal

Bureau of Investigation Director J. Edgar Hoover's watch, the FBI kept

close tabs on Malcolm's every move through the use of informants and

agents. Even before Malcolm began attracting large audiences and

widespread media coverage in the late 1950s and early '60s, the FBI

reported on his efforts to organize Nation of Islam mosques around the

country. One organizing meeting in a private home in Boston in 1954 had

maybe a dozen or so people present; one of them reported to the FBI.

After

Malcolm left the Nation of Islam in March 1964, agents pondered the

prospect of a depoliticized more religious Malcolm, but still perceived

him as a threat. On June 5, 1964, Hoover sent a telegram to the FBI's

New York office that simply and plainly instructed, "Do something about

Malcolm X enough of this black violence in NY." One wonders, what that

"something" was.

In New York, the FBI's actions were complemented by,

if not coordinated with, the New York Police Department's Bureau of

Special Services, which regularly logged license plates of cars parked

outside mosques, organizational meetings, business and homes. The

actions of the police on the day of Malcolm's assassination are

particularly noteworthy. Normally up to two dozen police were assigned

at Malcolm X's rallies, but on February 21, just a week after his home

had been firebombed, not one officer was stationed at the entrance to

the Audubon ballroom where the meeting took place. And while two

uniformed officers were inside the building, they remained in a smaller

room, at a distance from the main event area.

The

lack of a police presence was unusual and was compounded by internal

compromises on the part of Malcolm's own security staff, which included

at least one Bureau of Special Services agent who had infiltrated his

organization. Reportedly at Malcolm's request, his security had

abandoned the search procedure that had been customary at both Nation of

Islam and Muslim Mosque/Organization of Afro-American Unity meetings.

Without the search procedure, his armed assassins were able to enter the

ballroom undetected. When the assassins stood up to shoot Malcolm, his

security guards stationed at the front of the stage moved not to secure

him, but to clear out of the way.

These

anomalies, in and of themselves, could have been inconsequential. But

combined, even if just by coincidence, they proved to be deadly, and

allowed for one of the most prophetic revolutionary voices of the 20th

century to be silenced. The investigation that followed was just as

careless. The crime scene was not secured for extensive forensic

analysis -- instead, it was cleaned up to allow for a scheduled dance to

take place that afternoon, with bullet holes still in the wall!

For

activists, of course, Malcolm X's death took on greater significance

than law enforcement publicly expressed. Congress of Racial Equality

Chairman James Farmer was among the first to suggest that Malcolm's

murder was more than just an act of sectarian violence between two rival

black organizations. "I believe this was a political killing," he

asserted, in response to Malcolm's growing national profile within the

civil rights movement. He called for a federal inquiry -- unbeknownst to

Farmer, an ironic request given the level of covert federal oversight

that was already in place.

Slowly,

Farmer's doubts gained considerable traction. Author and journalist

Louis Lomax, who had covered Malcolm X and the Nation of Islam on

several occasions, put Malcolm X's assassination in context with Martin

Luther King Jr.'s in "To Kill a Black Man" (1968). More than four

decades ago, activist George Breitman was among the first to challenge

the police version of who was responsible for Malcolm X's death. More

recently, the work done at Columbia University's Malcolm X Project,

culminating in Manning Marable's Pulitzer Prize-winning "Malcolm X: A

Life of Reinvention," echoed these doubts and put at the forefront these

unanswered questions about Malcolm X's murder.

These

questions deserve answers. They call upon us to revisit not just the

political significance of Malcolm X's life, but the implications of his

murder. Our government especially deserves scrutiny for its covert

information gathering, disinformation campaigns, and even violence waged

against its own citizens. Fifty years later, we still have more to

learn from Malcolm X's life, and his death, and our government's actions

toward him.